SIMPLIFY YOUR TRADING

100% AUTOMATIC / 0% STRESS

FOLLOW A REAL TRADER

easylife

Thanks to CopyTrading you can automatically replicate the strategies of my best Algorithmic Portfolios.

(Presented version: July 2024)

easylife original

easylife original is our first product open to the public,

born in October 2022. Initially it was a single Trading

System multi-symbol on 15 forex pairs. Today it has evolved

into an extremely more complex and advanced portfolio.

easylife infinity

easylife infinity is our second product, born in September 2023,

with the goal of creating diversification for our audience. The name

comes from the fact that the system initially integrated adynamic

trailing stop on positions and averages. Also this product, at

today, has become a portfolio and no longer a single Trading System.

easylife serenity

easylife serenity is the latest addition to the easylife family at

beginning 2025, aiming to bring further diversification to our

audience. The third portfolio, a sibling of the first two, repurposes the same

trading system composition, but with different optimizations and

a lighter and more conservative averaging multiplier.

Minimum recommended capital 2500€

No fixed costs, only Performance Fee

8 100% Automatic Trading System

5 years Backtest, 2 years Live

No VPS needed

No constraints, direct assistance

Minimum recommended capital 2500€

No VPS needed

8 100% Automatic Trading System

5 years Backtest, 2+ years Live

No fixed costs, only Performance Fee

No constraints, direct assistance

Affiliation

Want to offer your audience an effective, tested, ready-to-use Trading service?

Contact me so you can offer easylife to your audience and create a win-win relationship

- Unparalleled product in the Forex/CFD market

- 100% automatic for you and the end customer

- Division of Immediate Performance Fee

- Possibility of IB relationship with Broker

- No VPS, no installation

What is and why Forex?

Forex is nothing but the global trading market between the currencies of various nations, which is why we talk about "pairs" such as EUR-USD i.e. Euro traded with U.S. Dollar, GBP-USD i.e. British Pound with U.S. Dollar, etc.

Exactly as when you get your money exchanged into foreign currencies at the airport you can make a gain or a loss by doing the same trade in reverse by letting time pass.

Knowing how to make a Trading trade is not easy, so you need a deep knowledge of the market.

Using a fully automatic Trading System portfolio specially programmed and designed to work on Forex, can be nowadays an excellent investment or diversification for your future.

What is easylife?

The world of trading and finance is complex, full of pitfalls, scams and false promises of easy gains.

easylife was created to offer a serious and sustainable alternative by providing a portfolio of Trading Systems developed and managed by a professional with experience and real demonstrable results obtained over the years. Each System within the portfolio is designed, coded, tested and optimized by me personally. The entire operation is constantly monitored and updated periodically to ensure performance and reliability.

With easylife, there are no unrealistic promises, just a methodical and professional approach based on numbers and statistics, designed for those seeking steady growth and sound risk management.

Access is provided in CopyTrading mode ("eToro" style) so the end client does not have to deal with anything, everything is entirely managed by the software and theauthorized broker.

Born in early 2022 as a single Trading System, today easylife has become, after numerous updates and implementations, a truly diversified and decoupled portfolio. All Systems are developed on MetaTrader 5 with multi-year real-tick backtests on pairs of Forex major and minor and are subject to progressive evolution based on new research and market conditions. Each Portfolio System before being used on Live accounts must: pass strict tests on known historical data (in-sample) and on future data (out-of-sample), meet parameters of return-drawdown ratio, win-rate and other statistical metrics. Great care is taken to avoid overfitting systems, thus ensuring a solid statistical advantage.

easylife is able to automatically analyze the economic calendar by being able to suspend Trading on Pairs interesting impactful macroeconomic news, and then reactivate under appropriate market conditions. The portfolio is equipped with a dynamic decorrelator to avoid excessive exposure on different pairs linked to the same currency

Who is the service for?

- To those looking for a 100% automated strategy

- To those who want to rely on a professional forgetting all difficulties

- Those who want to diversify their investment portfolio

- To those seeking a technologicallyadvanced service

- To those who haveserious and realistic prospects and are not looking for "easy money"

- To those with a medium- to long-term time horizon (1+ years)

- To those seeking a regulated and transparent service with no hidden costs and no strings attached

Why CopyTrading and not EA for sale?

easylife is not a classic "plug and play" Trading System, but a real portfolio that is constantly evolving; installation and management by a user other than the programmer himself would therefore be impossible.

In addition, CopyTrading has numerous advantages for both client and software provider.

For the customer:

- It is a much more ethical service, in that there are no classic, rather onerous upfront costs of buying a Trading System, access to the service is free, and you pay only a percentage of any profits made.

- This can all be handled anonymously without contact between customer and supplier.

- No setup and installation of software, libraries, platforms, etc. is needed.

- There is no need to rent a VPS (Virtual Private Server) or keep a PC on 24 hours a day to run the System.

- There is no need for checks and maintenance in case of problems on the operating system, no connection, power outages or upgrades.

- The client is free to discontinue CopyTrading at any time, with no strings attached with the provider and without having paid for something they will no longer use.

For the supplier:

- It has much more incentive to maintain an efficient service, as without positive performance it has no profit.

- He is free to update and modify the Systems during the course of work without the need for the client to intervene.

- Intellectual property on software is protected from hacking and software piracy.

Cost Transparency

I believe inethics in Trading as well. That is why I decided to focus solely on the Performance Fee, calculated on theHigh-Water Mark (HWM). This means that I am paid a percentage only if I generate a profit for you first.

Your percentage of the earnings that easylife generates.

- Zero registration costs

- Zero Fixed Costs - No Management Fee

- Zero Costs on Volumes - No Volume Fee

- Zero cancellation penalties

- No VPS

Sign in to the Telegram channel

Access the Telegram channel where you will find all the latest easylife news , communications and analysis

Check out the myfxbook track record

Performance may differ among accounts due to differences in the Brokers used, the start-up date, the risk profile adopted, and other factors.

Algorithmic Portfolio 100% automatic of Trading System easylife

Investor passwords provided upon request

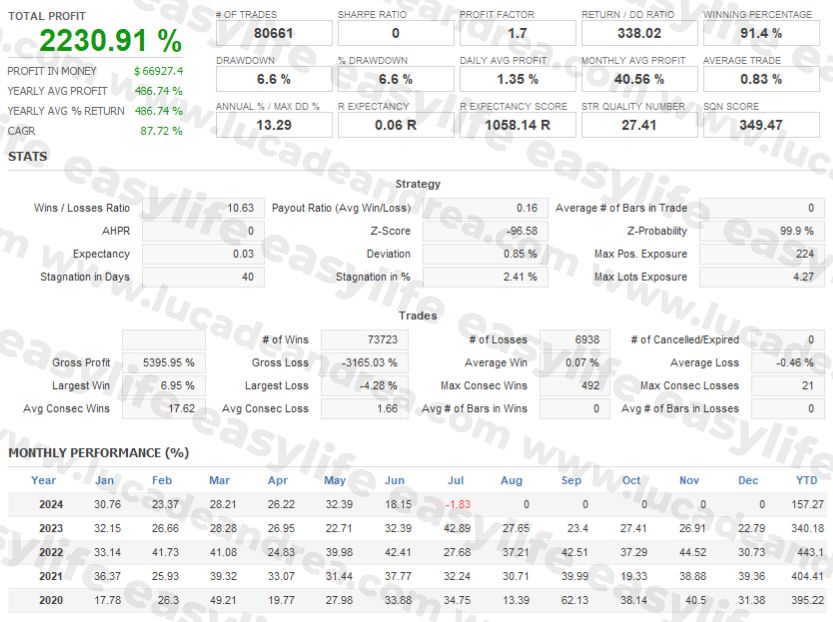

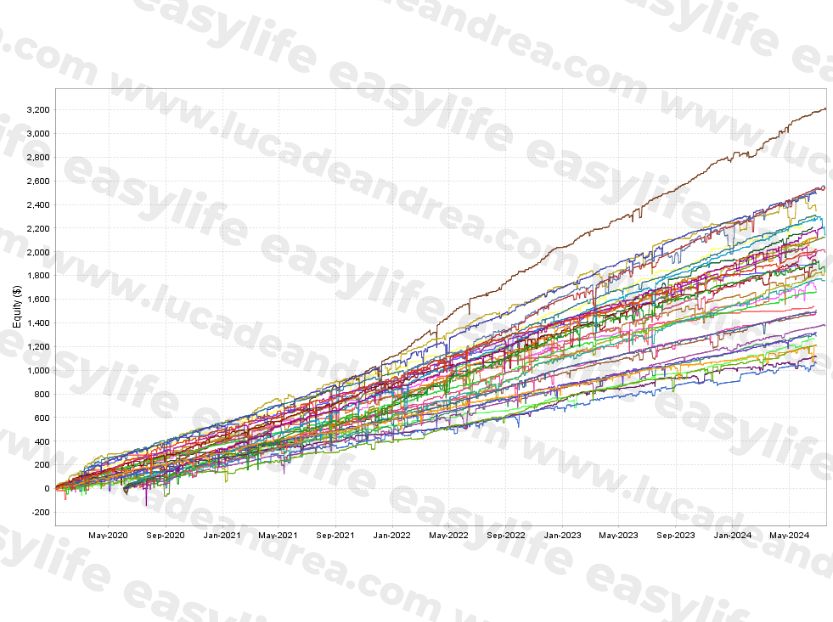

Backtest easylife original

(Presented version: July 2024)

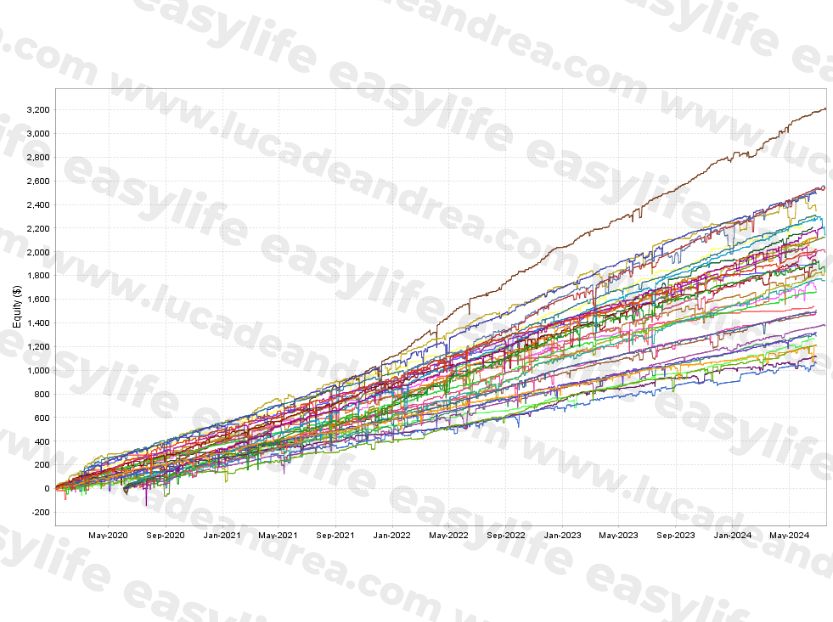

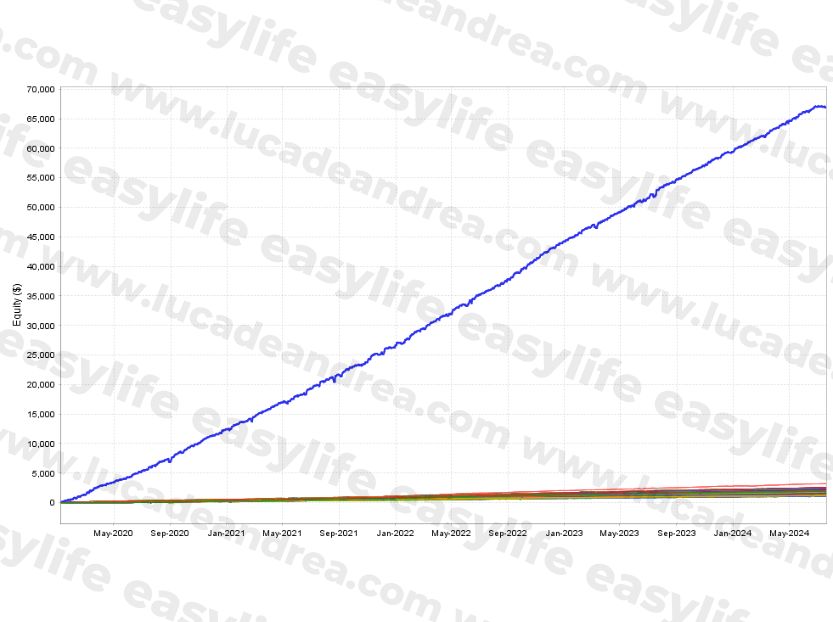

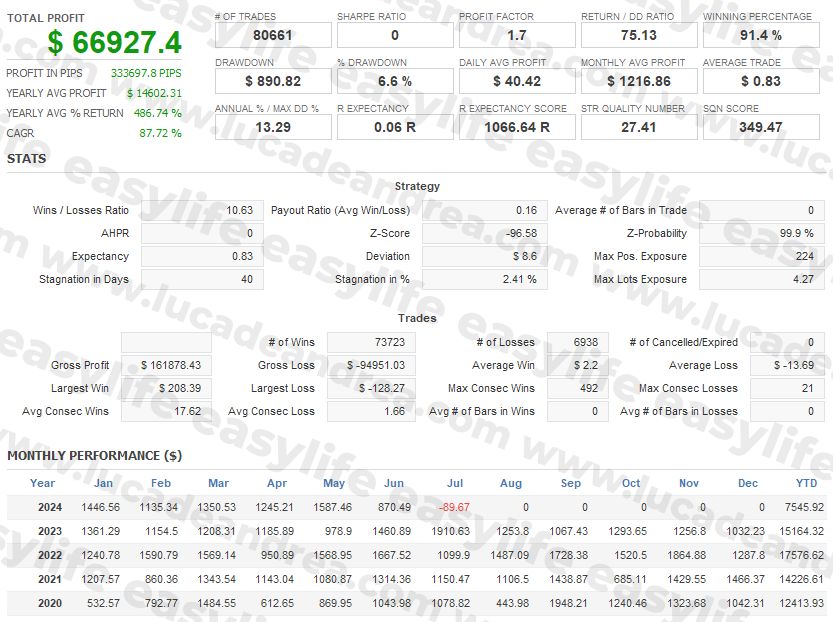

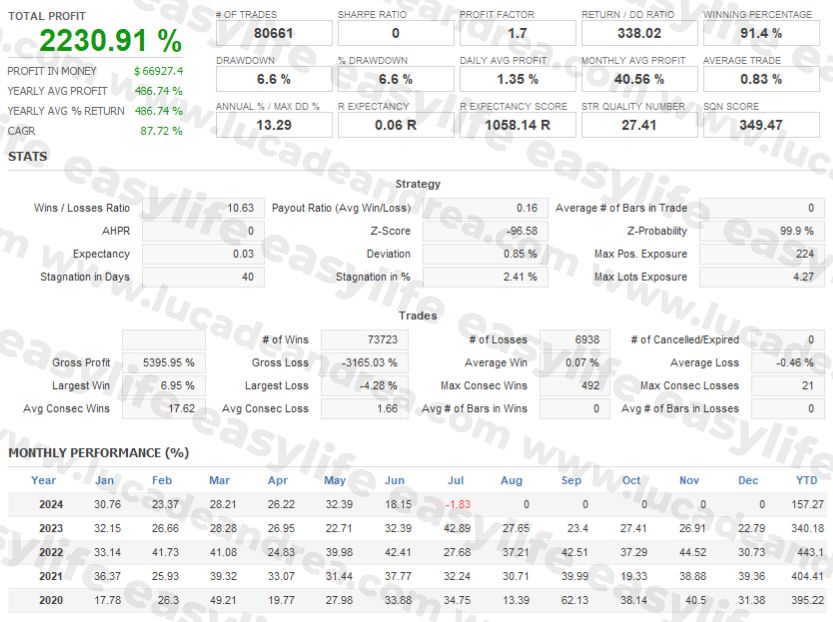

Backtest performed from 01/01/2020 to 17/07/2024 (4+ years) on MT5, 5 Trading System, 36 active charts.

Initial capital $ 3000, final capital $ 69.927 (+2230%). Without using compound interest, Lot Size fixed order basis 0.01 Lots..

Maximum Relative Drawdown $890.

(Please note that the Backtest is a simulation on historical data, they are not performances obtained on real money).

FAQ

There is no activation fee for the service.

Once CopyTrading is initiated, only on net gains does the service provider (Spotware or FP Markets) retain and pay the strategy provider a Performance Fee of the 50%.

The performance fee is calculated on the logic of High-Water Mark, that is, whenever a new maximum on theequity of the account. The High-Water Mark (HWM) guarantees commissions only for profits that you have actually generated and that do not overlap with profits from previous periods.

No amount is withheld during any periods of drawdown.

The only other costs are those of the CFD market such as Spreads and Commissions present in any type of financial transaction.

To work with a conservative profile we suggest a capital from € 2500 and rising.

With greater capital it will be possible to adjust market exposure proportionately.

Gains depend on the capital invested and the risk profile adopted.

The various myfxbook histories and backtests above are available to analyze how the software has performed in the past.

It should be remembered that past performance is not indicative of future results.

There is no constraint between the client and the strategy provider. The client is free to start, suspend, and stop copying at any time.

Capital is withdrawable at any time.

No notification to the provider is required for service interruption.

Low-risk capital needs to be invested with a minimum time horizon of 1 year. Only then will it be possible to see the fruits of the work done by the system.

Currently, the best conditions have been found through:

MetaTrader 5 on the broker FP Markets, Social Trading service.

Full details on access are provided at the contact stage.

Certainly, via MetaTrader 5 for mobile or desktop.

No, CopyTrading works in the cloud. All the client needs to do is to start the service on the Broker and the trades will be automatically replicated to their account. Via the MetaTrader 5 or cTrader for mobile or desktop it will be possible to monitor performance.

Yes, it is possible to go and leverage the gains made to increase market exposure. Contact me for more information.

No. The client's capital is not delivered into the hands of a manager, but rather is deposited by the client into a Trading Account of his or her sole ownership and access. The client, of his or her own free will, decides to register for a replication trading service from another Trading Account offered as a Strategy Provider by the Broker, regulated to provide this type of service. The client accepts the Broker's Terms and Conditions of Service.

The capital remains in the hands of the client, who is free to initiate copying, suspend and discontinue it at any time. The service can also be initiated totally anonymously without contact between client and provider.

Service interruption requires no notification to the strategy provider and does not involve any liens or penalties.

Capital can be withdrawn at any time, in whole or in part.

The risk mode at which CopyTrading is to work is decided by the client, with an optional Stop Loss set at the client's discretion.

The strategy provider in no way has access to the funds in the client's Trading account, nor to the client's personal data.

As reported in the previous point, yes. This is a CopyTrading operation offered by a licensed broker with the necessary licenses, in this case FP Markets or Spotware. The strategy provider is not, and does not need to be, a financial advisor or other type of entity. There is no customized asset management and/or financial advice.

The customer of his or her own free will decides to use this service by accepting its Terms and Conditions, potentially even anonymously to the strategy provider.

The capital always remains in the hands of the client on a Trading Account of his or her sole and exclusive access, with no constraints on the strategy.

FIRST PRUDENTIAL MARKETS LTD is on the list of Investment Firms Authorized In Other EU States Without Branch In Italy with Listing No: 5035

No. There are no safe investments, no monthly or annual percentage is promised. The entire capital as in any investment is at risk, so one should only invest an amount that in case it is lost will not impact one's condition economically.

Anyone promising safe and steady gains is promising falsehood.

The provider recommends a low and conservative risk profile.

However, the provider is committed to keeping the service performant and up-to-date over time. In case of dissatisfaction, the customer will be free to discontinue the service without cost and/or penalty.

All users are responsible for evaluating, selecting, and monitoring the suitability of each copied account and the overall performance of the signal provider on CopyTrading, based on their own risk tolerance.

To offer the service, as a matter of course, one must rely on a broker who has the necessary regulations and instrumentation.

As far as FP Markets is concerned, the Broker was chosen after multi-year personal trials, tests of its soundness, transaction costs, company size, safety and security of funds, quality of support, speed of withdrawals, and flexibility of the CopyTrading platform. If better conditions on other Brokers are identified in the future, the service may be offered elsewhere.

Should the account be on the FP Markets-Live broker, yes. Otherwise, it is not possible as the service is offered through FP Markets Social Trading

The Portfolio is constantly monitored and tests are conducted to evaluate possible technical or performance improvements. In the case of changes or news, customers are notified on the official Telegram channel. In any case, client-side no action is required.

Since its launch, the strategy has seen numerous updates, steadily evolving into a truly diversified and decoupled portfolio.

This is a Trading System portfolio with dollar-cost averaging (DCA) logic based on technical indicators to identify counter-trend entry situations. The system has a narrow Take Profit level, in case of a market in the opposite direction, averaging and Stop Loss are worked.

A very conservative size is recommended.

The system may be modified and updated over time by the strategy provider.

During daytime hours, the Portfolio is supervised by human eye. In addition, numerous filters such as News filter, Spread filter, volatility filter, operating hours, etc. are provided to safeguard the System from abnormal conditions. The Portfolio's high-performance execution VPSs are monitored h24 via Alerts and disaster-recovery systems.

Technically, yes, but it is not recommended so as not to interfere with copy operation.

A Trading System is software programmed specifically to trade financial markets automatically.

Both intermediary providers of the CopyTrading service require the age of majority (18+) for enrollment

Contact me at the contact information on the appropriate page